When I was a child during the 1940s, cash was king. Checks were an unknown commodity to most people. All employees, from the president of the company to the company’s janitor, were at this time paid in cash. Most companies paid their employees on Friday. Due to the large amount of cash businesses and merchants had to keep on-hand, they all had a safe on their property in which to store cash.

My dad would come home on Friday night with a brown envelope full of paper money and some change. He would hand it to my mom who would count the money out on the kitchen table to ensure the money in the envelope equaled the pay stub. Mom would give dad some money for bus fare and the purchase of a case of beer and a carton of cigarettes, plus enough to cover Wednesday night bowling. The rest of the money mom divided into various amounts and placed these amounts in separate envelopes to cover food and shelter needs.

Why were workers not paid with a check? This was because many considered a check a legal document and thus subject to tax. There was also no national clearing house for checks. A check drawn upon Fifth-Third Bank of Cincinnati and presented to State National Bank in Frankfort, would be discounted as State National would have to make arrangements to take the check to Cincinnati for redemption. All corporate and government bonds stated in their text that payment would be made in gold coins, not by check. Western Union flourished at this time by providing a means of moving money, at a cost, across the United States from one person or business to another.

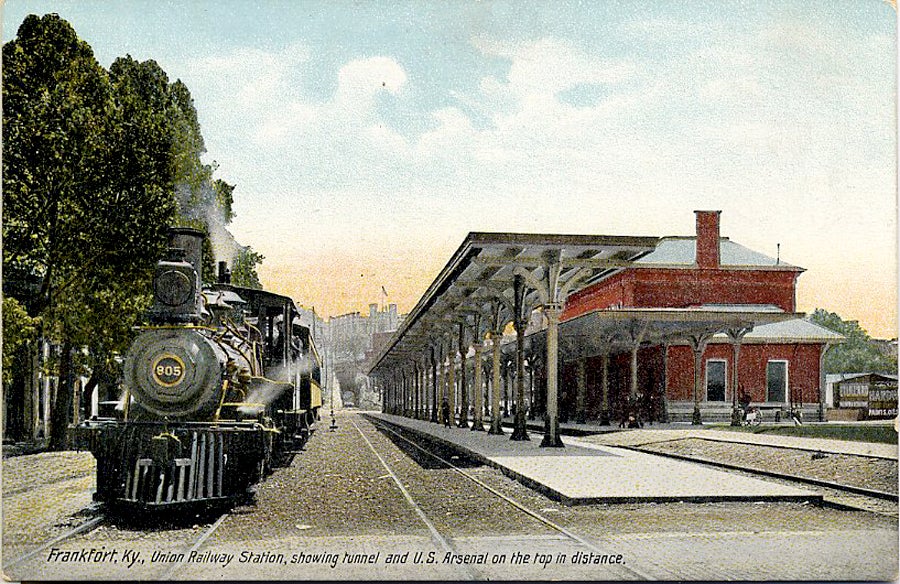

Twice a month the Louisville & Nashville Railroad (L&N) pay train would call at the Frankfort Depot. (L&N) workers would queue up and board the pay car to receive their wages. Wives would often be waiting at the rear of the pay car to ensure the money made its way home and not to one of the bars lining Broadway. All stores had large cash registers to handle the money flowing in and out of the store. Many of the larger stores used a pneumatic tube system to send purchase money to a central financial office and have change sent back.

This all changed starting in 1952. In that year, the federal government mandated that all businesses having over 200 employees had to pay their workers with a check. The check’s stub had to show hours worked, wages earned and deductions for social security, union dues, insurance and taxes. Over one-third of the United States work force was covered by this law. Here in Frankfort, it was state workers and employees of the L&N.

Employees who received paper checks had to take the check to a bank to cash. Thus, in Frankfort, both State National Bank and Farmers Bank & Trust quickly began to convince these check cashiers to deposit part of their paycheck in a savings account. Soon, individual checking accounts were offered, and the world changed. Those of a certain age can remember when, on Friday night and on Saturday morning, Frankfort’s bank lobbies would be jammed with people cashing their work checks. What could not be more natural with money in their pocket for the check cashier to stop at one of the local downtown stores to purchase something, go to a movie or eat out.

The development of a nationwide checking service would create the doorway for the development of credit cards. Credit card issuing banks would eventually give us debit cards. Debit cards would grow into gift cards, and the world I knew as a child changed forever.

I was recently in downtown Frankfort standing in the Whitaker Bank lobby at 3:45 p.m. on a Friday afternoon. There was only me, a teller and a support staff person in the lobby, or maybe in the whole building. Where was the rest of humanity that would jam the bank lobby on a Friday afternoon and evening during the late 1960s and early 1970s? Oh, yes, I forgot. We now have direct deposit and direct withdrawal. No human interaction is now needed to move money across the world. Downtown Frankfort will never be the same.