“This is just a process that you through. I’m here to answer the questions my clients might have and go over every detail with them”

Melissa Johnson, Vice President of Secondary Market Mortgage Lending at United Bank, is your go to guide for starting and finishing the daunting task of obtaining a mortgage for your home. With over twenty five years of experience in both commercial and mortgage lending as well as her impeccable customer service and attention to detail, Melissa can provide a seamless and low-stress experience for loan applicants. Whether you are a first time buyer or looking for a second home, United Bank not only has something for everyone, but also provides a truly experienced staff to walk you through the process. United Bank provides essentially any type of home loan you could be interested in: VA Loans, FHA Loans, Rural Housing Loans, ARM Mortgages, Conventional Fixed Rate Loans, Kentucky Housing Corporation Loans with Down Payment Assistance, and even home equity lines of credit. The variety of options allows United Bank to be able to provide something for everyone.

“Every individual’s situation is different and [we] look at each situation to meet [the client’s] needs.”

Melissa is an outdoor loving, Cardinal cheering, Louisville, Kentucky transplant. A story common around many small communities, Melissa and her husband moved to Frankfort in the early nineties for what was supposed to be a few years; however, it didn’t take long for them to fall in love with our charming and friendly community. Three children and three Miniature Dachshunds later, the Johnsons are officially ingrained in the Frankfort community. She has served on the United Way Board and she and her husband, a retired Frankfort PD officer, attend Capital City Christian Church. You can find them hiking the trails or simply hanging out around town enjoying the friendly atmosphere.

That small town charm is one of the more impressive aspects of United Bank. While United Bank has eight locations locally and even more throughout the state, the people that make up United Bank are part of our community and their community knowledge and experiences allow it to function as a hometown bank. Sometimes, what you really need during what can sometimes be a stressful financial endeavor is a person to talk to. This is a union of the best of both worlds: A small, hometown bank with the support and functionality of a big bank. You can apply for your loan in the comfort of your home, but call if you have a question. You can pre-qualify online based on daily updated rates, but stop in the office if you run into a roadblock during the process. If you can’t get to the Downtown Frankfort location, you can stop in any of the other convenient locations or even find someone to meet at your home. Melissa and her team at United Bank are here to make sure you are more than just a number plugged into a spreadsheet when you are applying for a home loan.

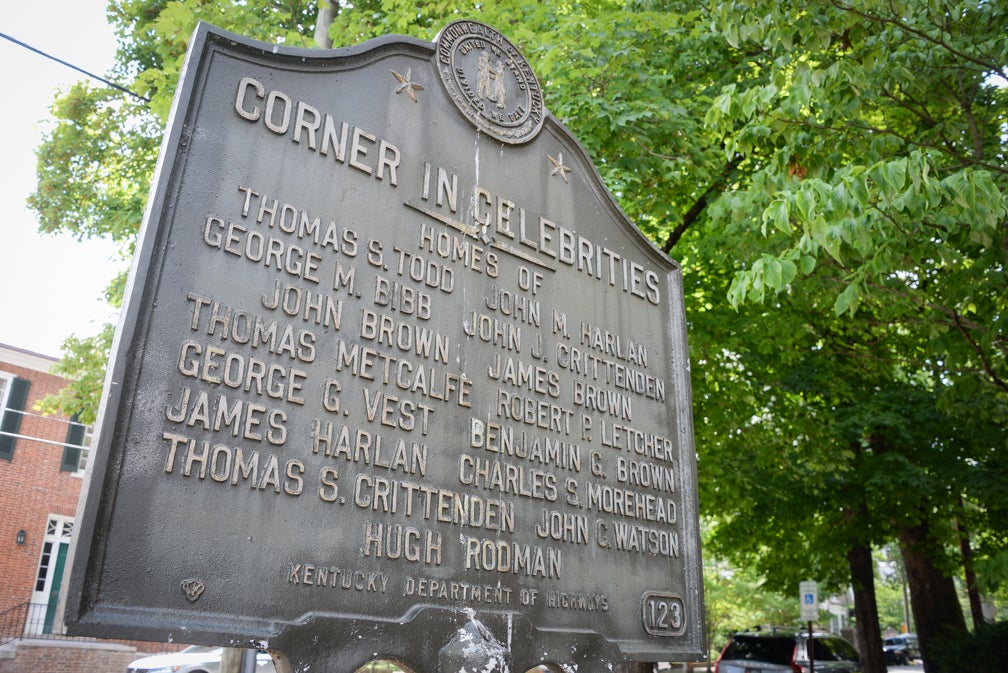

Melissa Johnson’s office is located at United Bank’s building at 125 W. Main St., Frankfort.

The assistance does not stop once you are approved either. Melissa is available for her clients to answer any questions they might have from application and even once your loan is approved and closed. Furthermore, as a full service bank, United Bank is able to provide you with almost anything other financial needs you may run into, including deposit accounts and trust and investment services. The best part is, you can expect the same level of attention, convenience, and service in any department of United Bank.

What is Melissa’s best advice for those beginning the exciting process of becoming homeowners and applying for a loan?

“Don’t be nervous. Come in with your questions and we’ll get through this together. Come meet our staff, let us put you at ease as you start the process and all the way through [the process].”